For many years, gold and other precious metals have been a way to protect wealth. In fact, people have been using gold coins and bars as a type of currency or investment for centuries. I’ve been in the precious metals industry for decades, and over that time, I have found that the most effective way to invest in gold is by opening a gold IRA.

The question you might have, however, is why gold, and why put it in an IRA?

Well, I know that gold is the type of asset that serves as a hedge against inflation. This isn’t something that paper assets like stocks, bonds, and mutual funds can offer. When the market dips and the economy starts plunging, cash and the stock market do, too. Gold, however, does not. When you place gold in a retirement account now, it will grow tax-deferred, or even tax-free, over time until you are ready to retire. Tax rules are outlined in full on this page.

I know this all sounds great, and it really is — but there is a catch. In order to open a gold IRA account, you have to work with a gold IRA company. There are many companies out there that offer gold individual retirement accounts, so how do you find the best?

Well, you need to do your research and start reading, because I have created a list of the top gold IRA companies out there based on my personal experience, my own research, and customer reviews. Keep reading to find out which are the best gold IRAs out there.

Best Gold IRA Companies: Top Gold IRA Companies and Reviews – Which Gold IRAs are Best?

#1. Augusta Precious Metals – Best Gold IRAs Overall

Augusta Precious Metals stands tall among all of the gold IRA companies out there. It has been my top pick for a very long time. It has a very strong reputation in the gold IRA industry, and many people also work with Augusta to buy other precious metals for investment purposes.

What sets Augusta apart? Augusta Precious Metals offers much more than a free gold IRA guide or a large product range – it also offers amazing long-term support and a fully transparent process that most other top-rated gold IRA companies simply don’t offer. I have worked with Augusta for many years, and I always get the top-level service and attention that I have always gotten.

From the first call, the team works hard to walk you through every step of the gold IRA process, and I have never felt pressured or tricked into buying anything. Instead, I feel like I can make well-informed decisions as I buy precious metals, and because the process is so simple, I always feel confident in my purchasing decisions. This is one of the reasons I keep going back to Augusta over other gold companies.

>> Visit Augusta Precious Metals

Augusta is a Trusted Company and Offers Great Value for Gold IRA Products

Something I have always noticed about Augusta Precious Metals is that they always have strict quality standards, yet they still offer a great value when compared to other companies. When you invest with Augusta Precious Metals, you get metals that are graded perfectly and valued fairly — and this is something that the industry, as a whole, has struggled with for years.

What Augusta Precious Metals Offers

It doesn’t matter what you are looking for, from a new IRA to gold or silver bars, coins, or bullion, Augusta likely has it. Here are some of the products available:

- Common gold bullion

- Common silver bullion

- Premium gold

- Premium silver

- IRS-approved coins for IRAs

What Makes Augusta Different

How did Augusta take the top spot on the list of best gold IRA companies? There are a few reasons why this stands out:

- Lifetime support – Many companies that offer gold IRAs are very kind and supportive…until the transaction is over. Then, they leave you in the dust. Augusta, however, has one of the best customer support teams out there, and they will stay with you and offer support for years to come.

- Personal investment guidance – Augusta creates investment guidance based specifically on your personal goals, income, and needs. This is not a one-size-fits-all package.

- Personal specialists – At Augusta, you will get to know the team you are working with, and they will get to know you.

- Private webinars – Augusta also offers private financial and economic webinars for customers that are led by Devlyn Steele, an economist trained at Harvard.

- Insight on retirement – The team at Augusta will help you think beyond precious metal investing and, instead, help you consider a full retirement strategy.

- The best storage – Augusta only works with the highest-rated secure storage facilities.

Customer Reviews and Ratings

Something that really stands out about Augusta Precious Metals is that it has amazing reviews, and they are consistently high, no matter which review site you look at. Here are some of the standout ratings:

- A+ from the Better Business Bureau with a 4.92/5 star rating

- AAA from the BCA, (Business Consumer Alliance)

- 4.9/5 star rating from TrustPilot

- 4.9/5 star rating from Google

Pros of Working with Augusta Precious Metals

- Augusta Precious Metals puts a strong emphasis on education

- Real-time price charts on the website covering precious metals pricing

- Offers free webinars hosted by a Harvard-trained economist

- The latest market news is always posted on the website, and visitors have access to an extensive video library

- Dedicated customer support team that is familiar with your account and goals who will work with you until it’s time to take an IRA withdrawal at retirement.

Cons of Working with Augusta Precious Metals

- The biggest con of working with Augusta is that there is a minimum investment amount of $50.000

Augusta Precious Metals Fees

The fees associated with Augusta Precious Metals as of August 2025 are:

- $50 setup fee (one-time fee)

- $125 annual custodian fee

- $100 – $150 annual storage fee

Augusta Precious Metals Options for Storage

When you buy gold or other metals for an IRA, you must store the metals in an IRS-approved storage facility called a depository. Augusta Precious Metals uses the Delaware Depository as its storage partner. This is one of the top depositories in the country; it is extremely guarded, and everything is insured.

>> Visit Augusta Precious Metals

#2. Goldco – Best Buy Back Program and Lower Minimum

If you are new to this concept and you want to hold physical gold in an IRA, one of the best companies I can recommend is Goldco. I have worked with Goldco for many years, and it’s one of those gold IRA options that can work well for almost anyone, thanks to the clear information and helpful guidance the team offers.

Based out of Los Angeles, Goldco has always been very professional, and it always seems to work hard to keep its strong reputation. Best of all, it’s a reliable company, it has a lot of transparency, and you always get personal attention here. This is why I have chosen it as one of the best gold IRA companies of 2025.

What Does Goldco Offer for IRA Purchases?

Goldco has many services and products available, including the following:

- Rollover support – To fund a precious metals traditional IRA or Roth IRA, you may need to rollover funds from an existing 401(k) or typical IRA. At Goldco, the team walks you through the process, making it a very easy process.

- A range of gold and silver coins for both IRAs and personal storage.

- Buyback options – If you need to, you can sell back your gold and silver to Goldco at competitive and fair rates.

Why Goldco Stands Out for a Gold Roth or Traditional IRA

Here are some of the ways Goldco really stands out from the crowd:

- Guaranteed Buyback – With the buyback program, Goldco sells gold and silver, which you buy. If you need, you can sell that gold back to them at fair prices.

- Live Chat – Some other companies could learn from Goldco and start offering a live chat feature. This is a convenient way to get quick answers when you need them.

- Insured Shipping & Free Metal Promotions – Many gold IRA companies offer free shipping, but Goldco takes it a step forward. For qualifying purchases, not only will Goldco ship and insure the metals you purchase, they will also add free metals, like free silver, as a promotion.

- Free Gold IRA Starter Kit – A gold IRA starter kit is an invaluable resource, especially for those who are new to this idea and don’t know how a gold IRA works.

All of this adds to the client-centered approach that Goldco offers. With Goldco, they are focused more on simply selling a product – they want to educate you as well.

Goldco’s Customer Reviews and Reputation

Though Goldco certainly has great products and you can get a wonderful IRA backed by gold, but it goes beyond that, too. The Goldco team is exceptional. They are always professional, kind, and helpful every time I have ever contracted them. They have always followed through, and I’m not the only one who has been so impressed with Goldco:

- Goldco has an A+ rating with the Better Business Bureau, and customers rate the company with 4.82/5 stars

- The Business Consumer Alliance, (BCA), has given Goldco its highest rating of AAA

- Goldco is also rated with a 4.8/5 star rating on TrustPilot

- Google reviewers have rated Goldco with a 4.9/5 star rating

Pros of Working with Goldco

Pros of Working with Goldco

- Goldco is a specialist in offering some of the best IRA options

- Low ($25,000) purchase minimum.

- The company has thousands of 5-star ratings on multiple consumer review sites

- Free, insured shipping and free metals on qualifying purchases

- One of the best buyback guarantees in the gold IRA industry

- The website features the latest gold IRA news

- Customer service is exceptional from start to finish, no matter if you are purchasing gold for an IRA or directly for your own trading purposes.

Cons of Working with Goldco

- I personally do not see any con’s of working with Goldco. In fact, this is where I personally purchased my precious metals from inside my IRA and the experience was first class all the way.

Why Doesn’t Goldco Share Fees?

The company claims that they don’t have any fees, and if you want to know what the annual IRA fee is for you, you should contact the custodian and storage facility, as they are the ones who set the fees. This isn’t as easy as it might seem, though…

Goldco Storage Options

Goldco also isn’t extremely transparent about its storage process. We know that the facilities are very secure and safe, but there aren’t a lot of details other than that.

#3. American Hartford Gold – Best for Low Pricing and Fees

I am also a big fan of American Hartford Gold, which is why it’s the third company on my list. I, too, have worked with this company, and I will tell you from personal experience that they are a wonderful option for those who want an IRA backed with gold or other precious metals.

American Hartford Gold has been in the precious metals IRA industry for more than a decade, and it’s easy to see why they have kept their spot as one of the best in the business. You choose the type of IRA you want, the team helps with the IRA rollover, and you will get to work with Equity Trust, one of the most well-known and highly respected custodians out there.

If you want to find the best gold IRA company, AHG is definitely a contender. They have a great selection of gold and silver products, and they offer a buyback program that allows customers to sell their metals back at a fair price.

American Hartford Gold is a company that has experience, is trustworthy, and responsive, and it’s certainly a company I recommend for those who are looking to invest in precious metals.

>> Visit American Hartford Gold

What is Available from American Hartford Gold

American Hartford Gold has a wide range of products and services including the following:

- Gold and silver bars

- Gold and silver coins

- Gold IRAs

- Silver IRAs

It doesn’t matter if you want to hold gold in an IRA to serve as a hedge against inflation or buy gold bars for personal investments – AHG has you covered.

What Makes American Hartford Gold Stand Out?

I love that American Hartford Gold is totally focused on one thing above everything else — their customers. Here are some of the ways they support the people who support them:

- A Guaranteed Buyback Option – If you need to, you can sell your precious metals back o the company at a fair price.

- Insured, Safe Shipping – The metals you buy from AHG are all safe and secure every step of the way.

- Personalized Guidance – AHG works closely with their customers to help them identify the best mix of metals based on their financial goals.

- Confidentiality – Every transaction you make with AHG is private, secure, and discreet.

Customer Ratings and Reviews for American Hartford Gold

You already know that I am a fan of American Hartford Gold, but you don’t have to take my word for it. There are thousands of customer reviews that have the same feelings about the company as I do.

- The Better Business Bureau has given AHG an A+ rating. Customers on the site have given AHG 4.83/5 stars

- Users on TrustPilot have given American Hartford Gold a 4.7/5 star rating

- Google reviewers have given American Hartford Gold a 4.8/5 star rating

Pros of American Hartford Gold

- American Hartford Gold has a very strong reputation for amazing customer support

- AHG offers promotions to investors like free precious metals and no maintenance fees

- 24/7 customer service

- There is a minimum investment of $10,000, but this is on the lower end compared to other companies

- Buyback program that is fair and easy to understand

Cons of Working with American Hartford Gold

- Prices for precious metals are not listed on the website

Fees Associated with American Hartford Gold

Because there are often promotions associated with American Hartford Gold’s fees, it’s difficult to track down the actual fees. I can tell you that the annual storage fee is around $180, and if there is no available promotion, you will pay around $200 for other fees.

Storage Options Available from American Hartford GoldSome gold IRA companies only offer one choice for storage, but American Hartford Gold offers three:

- Delaware Depository

- Brinks

- International Depository Services

>> Visit American Hartford Gold

#4. GoldenCrest Metals – Best for No Pressure Sales

Next, I want to talk about GoldenCrest Metals. Since this is a new company, many gold IRA investors may not have heard of it, but I’m advising you to take a look. The company has only been in business a bit over a year, but it has an amazing list of products, services, and more. It’s definitely making a name for itself in the gold IRA industry.

What is Available from GoldenCrest Metals?

GoldenCrest Metals offers physical precious metals and precious metals IRAs. You can buy some of the most well-known and sought-after coins, including Royal Canadian Mint Gold Maple Leafs, United States Mint Silver American Eagles, and many more. Investors can always find what they need from GoldenCrest Metals, and the options are great for both new and seasoned investors.

What Sets GoldenCrest Metals Apart?

You might be wondering why GoldenCrest is on this list and why it is a better company, in my opinion, than others on the list. First, it’s the commitment the company has to education. They have a host of different educational resources on their website.

Another thing that sets them apart is the focus they have on understanding their clients’ goals before making any recommendations. Transparent pricing, explaining market trends, and offering different storage options are all important. Their client-first approach has made GoldenCrest Metals an amazing partner for those who are looking for better financial stability

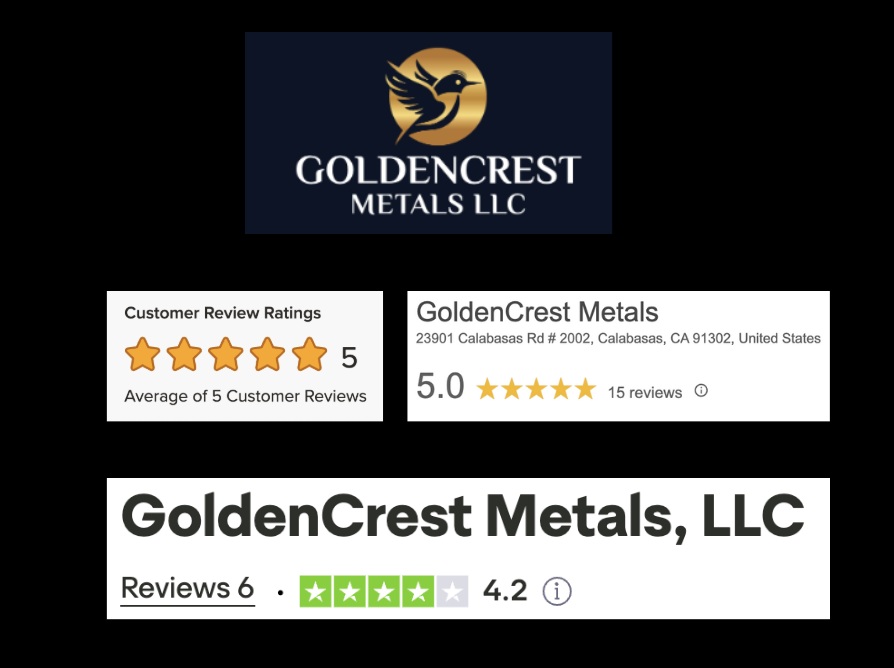

GoldenCrest Metals Customer Ratings and Reviews

I really like GoldenCrest Metals, and even though it’s a relatively new company, reviews are overwhelmingly positive.

- GoldenCrest Metals is accredited by the BBB, and it holds an A- rating. As of August 2025, it has a 5/5 star rating.

- On TrustPilot, GoldenCrest Metals has a 4.2/5 star rating

- Google customers have rated GoldenCrest Metals with 5/5 stars

Pros of Working with GoldenCrest Metals

- Offers a wide range of precious metals

- Competitive pricing and transparent fees

- Excellent customer service and educational resources

- Precious metals IRA options are available

- Strong industry reputation

Cons of Working with GoldenCrest Metals

- This is a new company, and though it’s been amazing so far, I don’t think it’s wrong to exercise a bit of caution as you would with any new company. That being said, I definitely still recommend it.

GoldenCrest Metals Fees

Currently, there is not a lot of information about the fees that GoldenCrest Metals offers. Since it’s a new company, it is giving new customers a “no fee” promotion. For those who want a gold IRA and want to know more about the fee structure, I would suggest calling GoldenCrest for more information.

GoldenCrest Metals Storage Options

GoldenCrest Metals also doesn’t share a lot of information about their storage options. They do say they offer high-security, insured depository options that meet industry standards. Clients can choose between domestic and select international storage locations, depending on their preferences and strategic needs.

#5. Noble Gold Investments – Best for Educational Resources

Finally, we have Noble Gold. For many years, Noble Gold has been an extremely reliable name in gold IRA investing, with more than two decades of experience in the industry. One thing that always impresses me about Noble Gold is that they are extremely transparent. I have an IRA with Noble Gold, and from the first steps of the IRA setup process to making decisions over the years, the people I have worked with are always upfront, clear, and honest about their products, fees, and risks.

Noble Gold has a reputation for working with some of the best partners in the industry, too. For instance, they work with Equity Trust, which is a very well-known and trusted IRA custodian. Noble Gold also offers a wonderful buyback service that allows customers to liquidate their assets when needed.

If you are looking for a company that makes gold IRAs easy to understand, Noble Gold is a great option.

>> Visit Noble Gold Investments

What Does Noble Gold Offer?

Noble Gold has a range of products and services, including collectible coins, investment-grade metals, and gold IRAs. Specifically, here are some of the offerings:

- Gold and silver coins

- Platinum and palladium coins

- Rare coins

It doesn’t matter if you are looking for wealth preservation over the long term or if you want to diversify your portfolio; Noble Gold will likely be a good option.

What Makes Noble Gold Stand Out?

Noble Gold is newer than other companies out there, but they have really done a great job at adding features that customers want to have available to them. These include:

- Storage in Texas – Noble Gold uses International Depository Services as its chosen depository. They offer IRS-approved storage, which is located in Dallas, TX.

- There is a Guaranteed Buyback Program – If you need to sell the gold you have, you can sell it back to Noble Gold for a fair price.

- “Royal Survival Packs” – The company offers pre-packaged bundles of precious metals that customers can buy for preparedness or emergency liquidity.

- Education – Noble Gold also has a lot of educational resources available to investors, and there is something for everyone — whether you are a beginner or an advanced investor.

Noble Gold Customer Reviews

I am a fan of Noble Gold, and so are many other people, based on the reviews I have found online about this company. Some of the things that stand out are the easy way it is to connect with someone and the fact that they offer platinum and palladium coins and bars, which is something that is becoming more of a rarity these days.

When it comes to consumer reviews, Noble Gold continues to stand out from the crowd:

- On the Better Business Bureau website, Noble Gold has an A+ rating, and reviewers have given the company a 4.97/5 star rating.

- TrustPilot users give Noble Gold a 4.9/5 star rating

- Google reviewers give Noble Gold a 4.9/5 star rating, too

Pros of Working with Noble Gold Investments

- Noble Gold’s website has a lot of educational content available

- Metals are stored in one of the most secure facilities in the US

- The buyback program allows you to sell your gold back to the company

- The customer service team is always ready to answer questions or offer assistance when you have questions about gold in your IRA

Cons of Working with Noble Gold Investments

- Noble Gold only works with customers in the US or Canada

- Prices are not available online

Fees Associated with Noble Gold

Here are the fees associated with Noble Gold. They are typical for companies in this industry:

- $80 setup fee (one-time)

- $275 annual fee, which includes $125 custodian fee and $150 for segregated storage

- $20,000 minimum investment

Noble Gold Storage Options

Noble Gold works with International Depository Services, which has locations in Delaware, Texas, and in Mississauga, Ontario, Canada.

>> Visit Noble Gold Investments

A Gold IRA – What is It?

A gold IRA is a type of retirement account that is self-directed, meaning you can choose to fund the account with IRA-approved gold and other precious metals. This type of IRA works almost exactly like a traditional or Roth IRA. The only difference between a standard IRA and a gold IRA is that, instead of stocks, bonds, mutual funds, or other investments, in a gold IRA, the account is backed with precious metals.

You can choose from several types of IRAs, including traditional gold IRAs, which is funded with contributions that are tax-free. However, when you withdraw the funds at retirement, they are taxed like income. Another type of IRA that is available is a Roth gold IRA. In this case, the contributions are taxed. However, this IRA allows you to take withdrawals that are tax-free at retirement.

Gold is one option for these IRAs, but you can also fund them with silver, platinum, and palladium. Gold IRAs follow the same contribution rules that regular IRAs follow, too.

Why Invest in Precious Metals Like Gold?

I have worked in the precious metals industry for a long time, and people ask me all of the time, “Why invest in different types of gold?” Here are some of the reasons I recommend it:

- Gold allows you to diversify your portfolio. Precious metals don’t tend to react to the economy in the same way that other assets, like stocks, do. When the economy is good, gold tends to fall in price a bit. However, when the economy is rocky, gold rises when other assets fall.

- Gold is also seen as a hedge against inflation. When paper currency begins to lose value, gold keeps its value during times of rising inflation.

- Gold is also very stable. Though you may not see huge increases all of the time, there is rarely a crash in gold value. We have data for centuries to back this up.

What to Consider When Searching for a Gold IRA Company

Though I have already given you five options for a gold IRA, not every company is going to be the best option for every investor. This is why I always recommend that you do your own research to find out what works best for you. Here are some of the things you should consider:

Reputation, Reviews, and Accreditation

It’s always important to consider the reputation of the companies you are considering, as well as ratings on trusted consumer review sites like the Better Business Bureau, Business Consumer Alliance, and TrustPilot. Most, if not all, companies will have a complaint now and then. What’s more important than focusing on one or two complaints is to look at the reviews and ratings overall. If a company has 500 reviews and 10 of them are negative, that means that only 2% of the complaints are negative. The rest are positive.

Consider the Storage Option

Another thing to consider is the type of storage facility the company has. All gold in an IRA must be stored in an IRS-approved depository. These facilities should have features like insurance, the highest level of security, and regular audits.

Fees

All of the companies in the gold IRA industry have fees, and it’s up to you to determine how you want to pay. Some of them offer a flat fee each year, no matter how much you have in your account. Others base the fees on the value of the precious metals you own. Some companies waive fees, too, if you have a certain amount in your account.

Customer Service

Finally, you should look into the customer service a company offers. This is especially true if you are a new investor. The best gold IRA companies will work with you and walk you through the process every step of the way.

Step-By Step – How to Open a Gold IRA

It is much easier than you think to open a gold IRA no matter what company you work with…as long as it’s a reputable one. Here is a quick step-by-step guide to show you what you can expect:

Step #1 – Fill Out the Application

Most gold IRA companies have a brief application on their website. That will get you started. Typically, you will need to provide your contact information, prove your identity, and provide your Social Security number. In some cases, you will also need to provide a beneficiary. Generally, this only takes around 10 minutes.

Step #2 – Add Money to the Account

With the help of a custodian, you will then fund the account. You can do this with cash, through a a 401(k) rollover, or by transferring from an existing IRA.

Step #3 – Choose Your Gold

When the account is funded, you can then choose the metals for your account. Again, your custodian or gold IRA company will help with this process.

Step #4 – Store Your Gold

Once you have chosen all of your metals, you will then have to store them in an IRS-approved depository. You cannot take the gold out of the depository until it’s time for your retirement.

Step #5 – Watch Your Portfolio Over Time

Now that everything is handled and stored, you can simply monitor your account over time. You are allowed to contribute to the IRA each year, as long as it stays within IRS limits.

In Depth Reviews of Each Company are Listed Below:

- Augusta Precious Metals Review

- Goldco Review

- American Hartford Gold Review

- Golden Crest Metals Review

- Noble Gold Review

Best Gold IRA Companies of August 2025 – Conclusion

If you are ready to invest, choosing the right gold IRA could be the difference between financial success or total defeat. Some companies out there don’t have your best interest in mind, and the fees are so high that they truly are mind-boggling.

Augusta Precious Metals is my top pick for gold IRAs, but not everyone can afford the $50,000 minimum that is required. I have also worked with the other gold IRA companies on this list, and I highly recommend all five of them.

Start your research now, read more reviews, and before you know it, you will be ready to start your own gold IRA.

Pros of Working with Goldco

Pros of Working with Goldco